Aster DEX Review 2025

- Trade major cryptocurrencies with leverage of up to 1001x

- Hidden orders do not appear in the public order book until filled

- Cross-chain trading without relying on bridges

Aster (ASTER) is one of the hottest Web 3.0 projects in the market. The Changpeng Zhao-linked decentralized exchange (DEX) offers on-chain spot and perpetual futures trading with 1001x leverage and hidden orders. This Aster DEX review reveals everything traders need to know.

We tested and researched the Aster DEX to evaluate key factors, from the user experience, security protocols, and supported markets to core features, fees, and margin facilities. Read on to explore the DEX in great detail and learn how it compares with other on-chain trading solutions.

Aster DEX: Pros and Cons

Aster appeals to speculative crypto traders who buy and sell perpetual futures with significant leverage. Since the platform offers 1001x leverage on BTC and ETH, users can amplify their positions by 1001 times. While Aster supports dozens of other futures pairs, these markets offer much lower leverage multipliers.

Another standout feature is the exchange’s collection of non-crypto products, which include tokenized stocks like Tesla and Meta Platforms, as well as major currency pairs. We also like the platform’s hidden orders concept. It enables traders to place limit orders without appearing in the public order book, so the mechanism protects users against frontrunning risks.

Our Aster review also identified some drawbacks. As Aster is a non-custodial platform, traders should be comfortable with on-chain trading and smart contract execution. Users cannot deposit fiat money, and the exchange places ROI limits on winning futures positions. The platform has operated since September 2025 only, which limits proper scrutiny.

Pros

- Spot trading and perpetual futures on a native Layer 1 network

- Users control their assets and avoid centralized counterparty risks

- Access leverage multipliers of up to 1001x on BTC and ETH

- Trade across multiple blockchains without relying on bridges

- Use yield-bearing assets as collateral to maximize potential returns

- Place hidden orders to protect positions from frontrunning manipulation

Cons

- Doesn’t suit crypto beginners who want to deposit with fiat money

- Non-BTC and ETH markets offer much lower leverage limits

- 0.08% commissions per side when using the 1001x feature

- Implements ROI limits on winning positions

- Other than ASTER, spot trading volumes are low

What Is Aster DEX?

Aster is a new DEX (decentralized exchange) that operates on a proprietary Layer-1 blockchain, Aster Chain. The blockchain specializes in on-chain trading solutions through high-performance, zero-knowledge settlement.

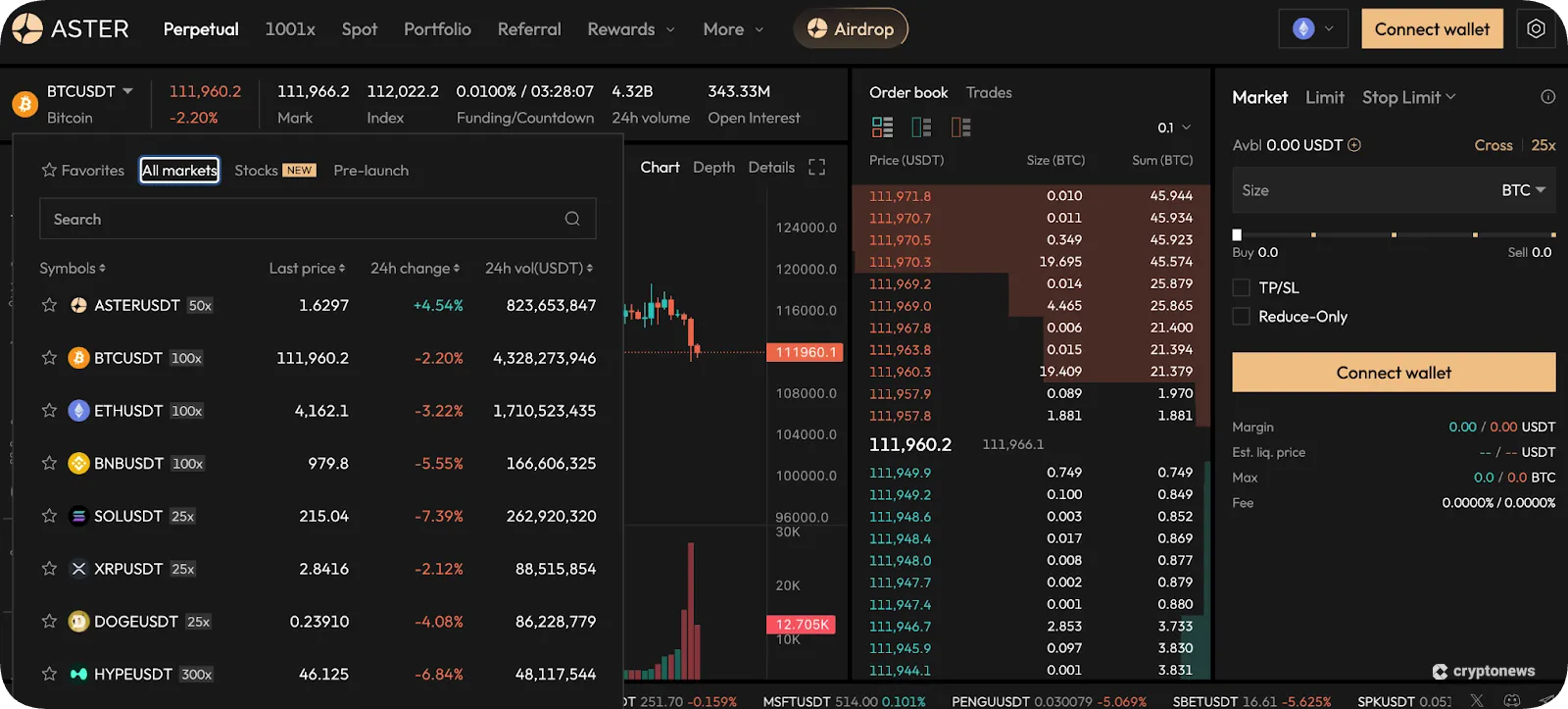

Platform users trade perpetual futures on a wide range of digital assets, including Bitcoin (BTC), Solana (SOL), Dogecoin (DOGE), and XRP (XRP). The basic mode offers 100x leverage on major markets, and up to 1001x in “Degen” mode. In addition to conventional spot trading, the exchange offers tokenized stocks covering leading U.S. companies like Apple and Tesla.

Because Aster is an on-chain DEX, users can buy and sell cryptocurrencies with reduced counterparty risks. In a similar manner to other DEXs, traders connect a non-custodial wallet and fund positions with supported digital assets.

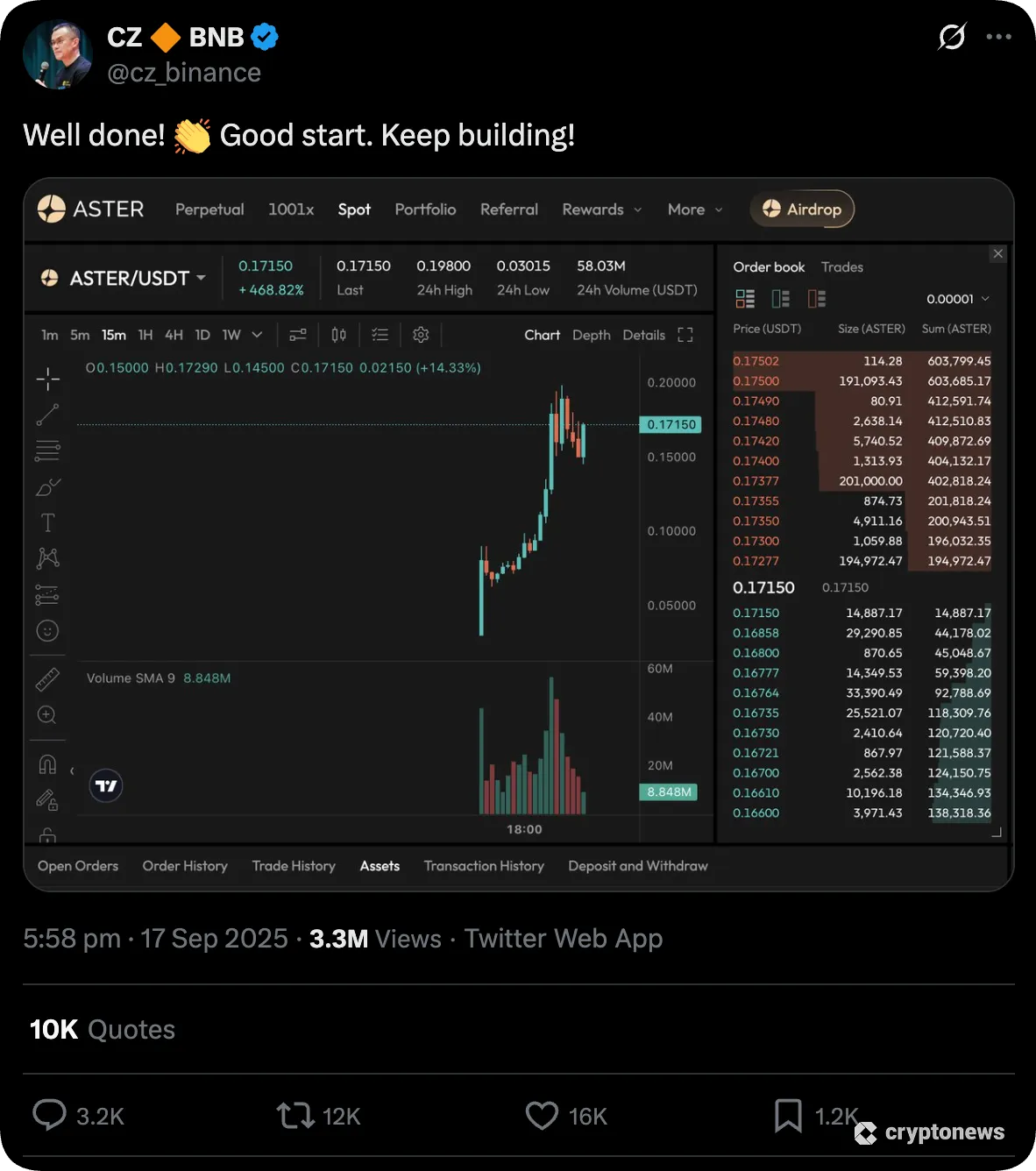

Despite Aster’s recent launch, over 2 million users have contributed over $500 billion in trading volume since its inception. According to research, the DEX’s near-instantaneous success is due to Changpeng Zhao’s endorsement. The highly influential ex-Binance CEO tweeted “Keep Building” alongside an image of the Aster platform. The exchange also received seed round investment from YZi Labs, formerly Binance Labs.

Market commentators explain that Changpeng Zhao’s involvement helps to position Aster as a powerful alternative to other on-chain DEX platforms like Hyperliquid (HYPER). Hyperliquid, like Aster, offers on-chain trading solutions with ultra-low margin requirements and deep liquidity.

ASTER, the exchange’s native token, is also widely considered the next crypto to explode in 2025. While most digital assets have experienced volatile prices in recent times, the ASTER utility token increased from $0.08439 to $1.97 during its first four days of trading. This parabolic growth reflects 23x gains.

What Type of Exchange Is Aster?

Aster is a top decentralized exchange that operates on a native Layer 1 blockchain. This framework enables traders to buy and sell cryptocurrencies without relying on intermediaries. The DEX revolutionizes the traditional order book system through on-chain trading, which provides users with a transparent and secure trading experience.

As Aster uses a non-custodial ecosystem, traders link a private wallet to the DEX and use stored cryptocurrencies as collateral. Aster also accepts yield-bearing assets as margin collateral, such as Staked BNB (asBNB). This mechanism enables traders to earn yields while their assets support leveraged positions.

Is Aster Exchange Safe?

Our research found that Aster is a safe trading platform due to its non-custodial structure. Since the exchange operates on-chain via a proprietary blockchain network, this reduces conventional counterparty risks like fund misappropriation, cyber hacks, and bankruptcy.

Unlike traditional exchanges such as Coinbase and Kraken, Aster users never lose control of their private keys. Instead, they connect a self-custody wallet like MetaMask, Exodus, or MyEtherWallet, and decentralized smart contracts transfer collateral to their Aster margin account.

Smart contracts also handle trade execution, and users may withdraw collateral at any time without needing approval.

Aster traders must, however, take full responsibility for wallet security. The platform does not have traditional safety features like whitelisting or two-factor authentication, as it functions as a decentralized non-custodial service. Therefore, Aster never directly touches client funds, so it cannot help recover them if user-owned wallets are breached.

Aster Supported Coins

The Aster DEX supports approximately 96 coins and tokens across spot and perpetual markets. Most users trade top cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), since they offer the deepest liquidity and tightest spreads.

The exchange also supports the best meme coins to buy. Speculative markets feature Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), Floki (FLOKI), and Fartcoin (FARTCOIN).

Traders may also access tokenized stocks, covering large-cap technology companies such as Apple, Microsoft, Amazon, NVIDIA, and Meta Platforms.

Note that Aster pairs most trading markets with USDT for simplicity, including crypto and tokenized stocks. Supported USDT standards include Ethereum, Arbitrum, BNB Chain, and Solana.

Aster DEX Key Features

Aster supports spot and perpetual futures trading with innovative features, including leverage, hidden orders, and on-chain settlement.

This section of our Aster DEX review explores each trading segment in more detail.

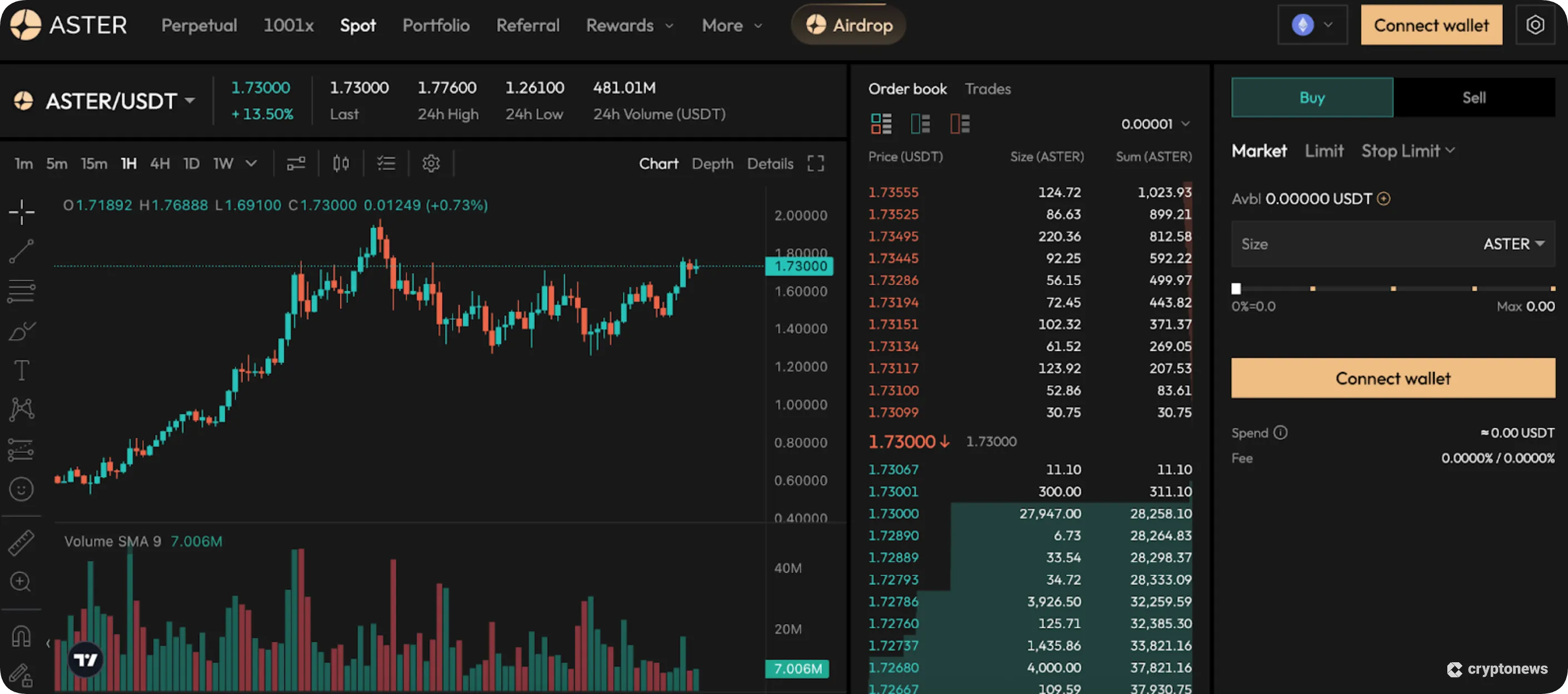

Aster Spot Trading

While most platform users trade leveraged derivatives, Aster offers a small selection of spot trading markets. ASTER, the exchange's native token, attracts the overwhelming majority of spot volume.

Popular pairs like BTC/USDT and ETH/USDT have minimal volume, with about $6 million traded in the prior 24 hours. Other supported cryptocurrencies include Four (FORM), Creditlink (CDL), and World Liberty Financial USD (USD1).

The spot trading process relies on a decentralized order book rather than automated market makers (AMMs). As such, order efficiency depends largely on available liquidity.

Aster Futures (Perpetuals)

Perpetual futures remain the most sought-after market on the Aster DEX. Its derivative trading feature supports dozens of cryptocurrencies with deep liquidity and competitive spreads.

Users go long or short, which allows them to speculate on both market directions. Supported order types include limit, market, and stop-limit, as well as risk management tools like stop-loss and take-profit orders. As Aster is an on-chain trading platform, smart contracts execute perpetual contract positions and safely store margin collateral without custodian-related risks.

The main futures platform offers a maximum leverage of 100x on BTC and major altcoins like ETH and BNB. Aster’s highest-leverage multiplier is 300x on the HYPER/USDT pair, which is an interesting feature since Hyperliquid is its closest competitor.

Tokenized stocks like Apple and Tesla also offer leverage. Capped at 50x, this feature reduces the initial margin by unprecedented amounts, since traditional brokerages typically require investors to deposit at least 50% of the purchase value.

Aster charges funding rates on perpetual trades every eight hours. It charges either long or short traders, depending on whether the funding rate is positive or negative at the time.

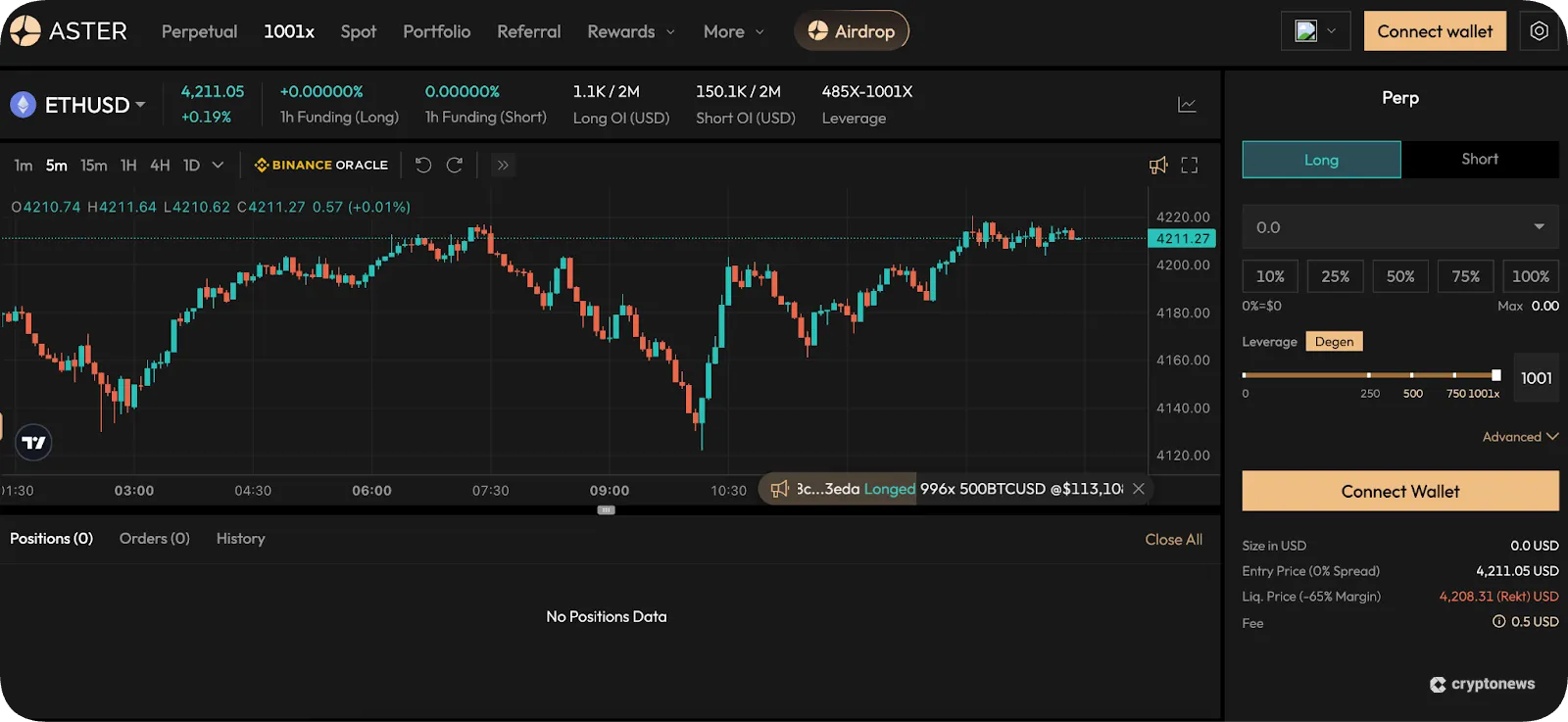

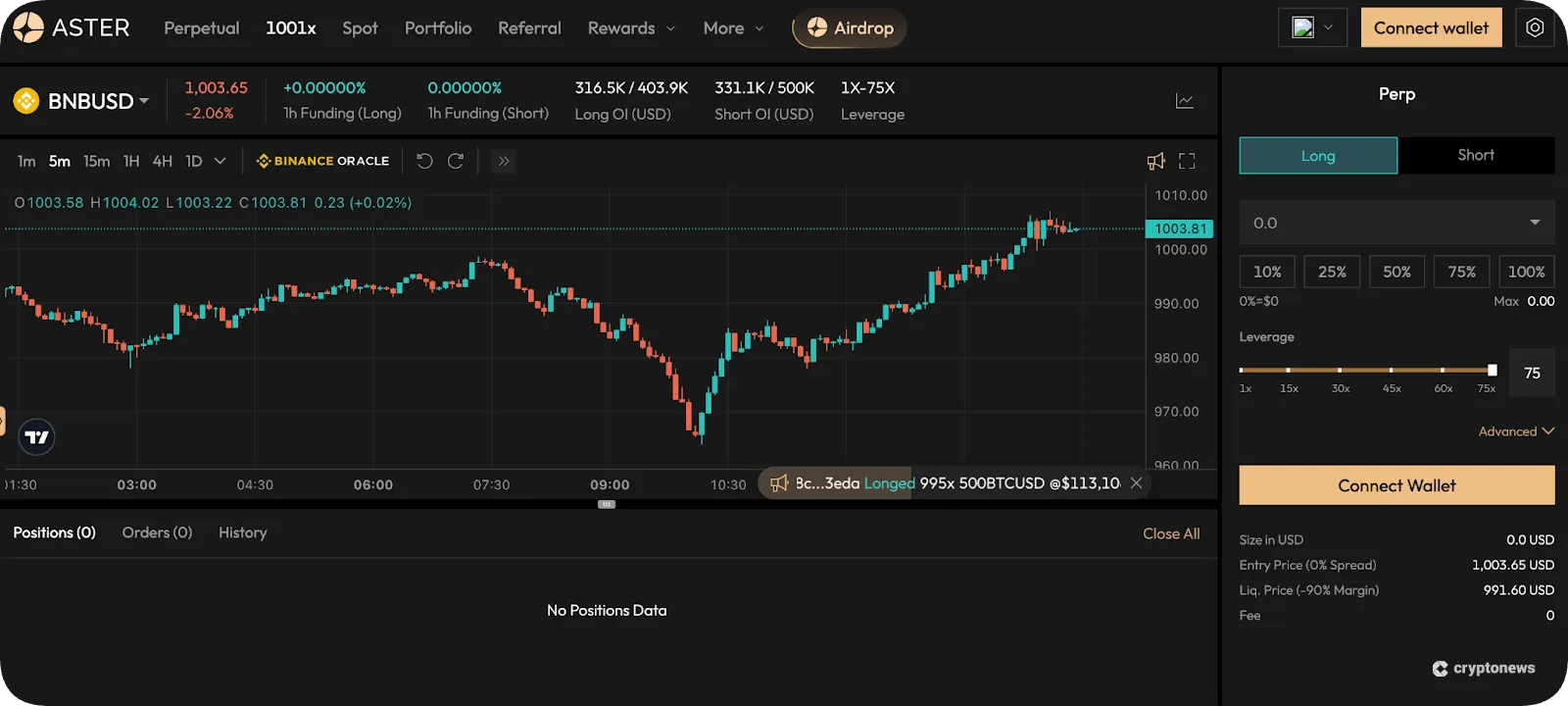

Aster 1001x

Aster offers a separate trading market called “1001x”. The market also specializes in perpetual futures, and Aster has adapted the interface to suit less experienced traders.

Users increase their leverage multipliers to 1001x on the BTC/USDT and ETH/USDT pairs. However, other supported markets offer lower leverage compared with the main perpetual platform. BNB/USDT, for instance, is capped at 75x, while it’s 100x on the primary mode.

To enter a position, traders select "Long" or "Short" buttons rather than setting up traditional exchange orders. As traders cannot access limit orders, they enter the market almost instantly at the next-best available price.

A drawback is that Aster caps the position ROI to between 300% and 500%, depending on how much leverage traders apply. The 1001x mode also restricts traders from adding additional margin to existing positions.

Project documents have outlined an upcoming “Dumb” mode. Available on the BNB Chain and Arbitrum networks, Dumb Mode resembles binary-style markets. The platform offers three expiration timeframes: 5, 15, and 30 minutes. Similar to the "Degen" multipliers, Aster limits the ROI to between 77% and 82%, as per the selected expiration.

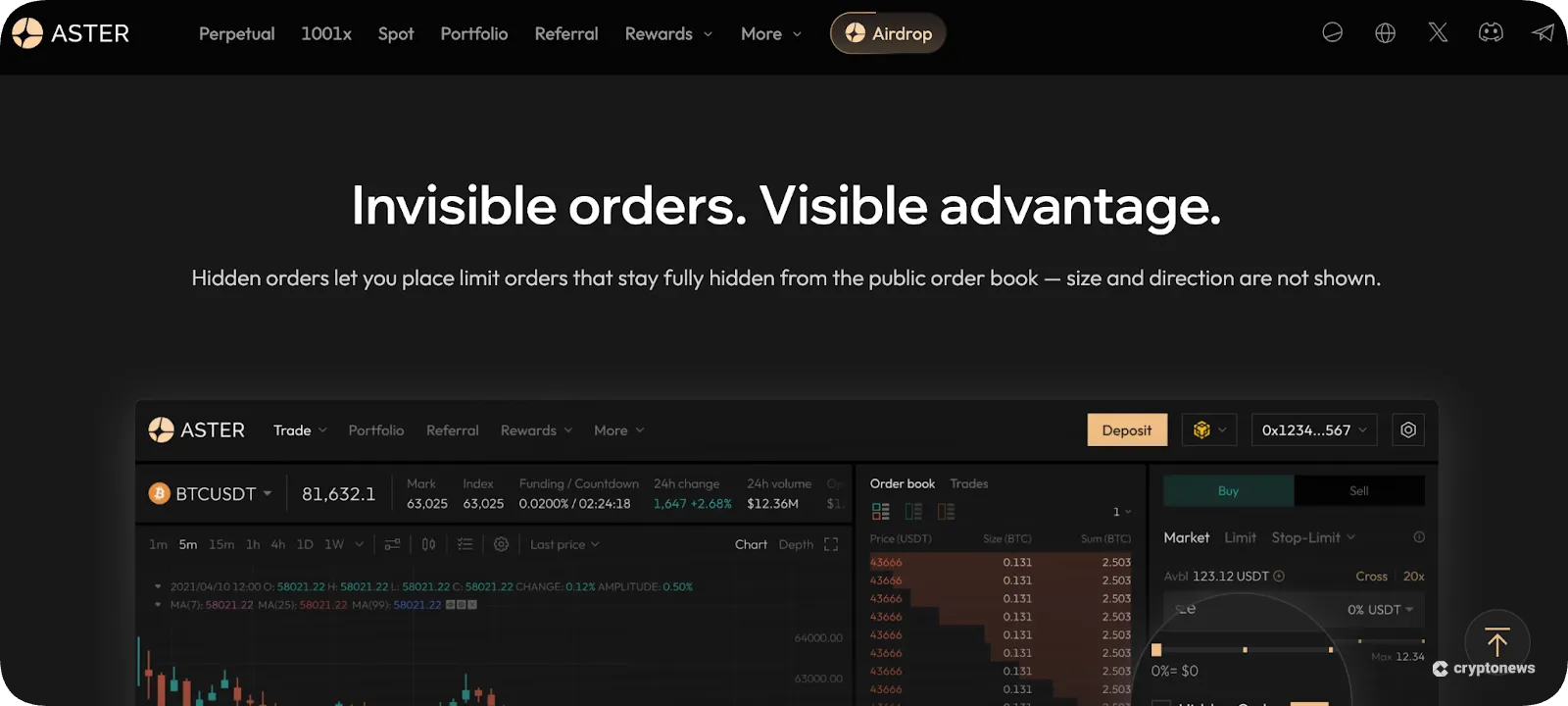

The Aster DEX introduces an innovative trading feature called hidden orders. The concept lets users place limit orders without market participants seeing them in the public order book.

As other platform users cannot view the limit price, volume, or direction, it protects traders from front-running bots and general manipulation. The order details appear only when it’s filled.

Yield-Bearing Assets

Although most traders use traditional digital assets as collateral, Aster also supports yield-bearing assets. This includes liquid-staked cryptocurrencies and interest-earning stablecoins.

Traders earn yields on those assets while using them as margin collateral.

Aster Token Airdrop

Aster’s tokenomics show that the team has allocated 53.5% of the total supply to airdrop campaigns. Participants include early adopters, community builders, and traders.

The project released 8.8% of the airdrop allocation at the token generation event (TGE) in September 2025. The balance is unlocked via an 80-month vesting period.

While the vesting timeframe is much longer compared with other new cryptocurrencies, it helps protect the supply and discourages participants from dumping their tokens for quick gains.

If you joined the airdrop event, ensure you claim your tokens on the official Aster website. Scammers often attempt to trick users into connecting their wallets to phishing websites, which enables the scammers to drain the wallets’ contents.

Aster vs Hyperliquid

Experts consider Aster a direct rival to Hyperliquid. Both platforms offer on-chain trading via perpetual contracts with high leverage multipliers.

Here’s how the two DEXs compare, in terms of their core factors:

- Trading Instruments: Hyperliquid specializes in perpetual futures, while Aster also supports spot trading and non-crypto markets like tokenized stocks and currencies.

- Supported Cryptocurrencies: Aster and Hyperliquid offer approximately 96 and 183 crypto pairs respectively.

- Leverage: Aster offers substantial leverage of up to 1001x on BTC and ETH, and between 50x and 100x on major altcoins like SOL and BNB. HyperLiquid limits leverage multipliers to 40x.

- Collateral: Another unique Aster feature is its multi-asset collateral, since it accepts USDT, USDC, and yield-bearing assets. HyperLiquid primarily supports USDC as margin.

- Compatible Chains: While Hyperliquid settles orders on its native network exclusively, Aster also supports BNB Chain, Solana, Arbitrum, and Ethereum. Cross-chain functionality lets Aster traders access multiple networks without relying on bridges.

- Hidden Orders: The stealth-focused hidden order feature is unique to Aster. Traders place limit orders without appearing in the public order book. No such feature exists on Hyperliquid.

Despite Aster offering more features and perks, Hyperliquid still dominates in terms of daily trading volume.

Aster Exchange Fees

Aster charges varying fees based on the trading product and order type.

Aster Pro, which is the main perpetual futures platform, charges makers and takers 0.01% and 0.035%, respectively. This makes Aster one of the lowest-fee crypto exchanges for derivative products. In contrast, Binance charges 0.02% and 0.05% on the same order types.

Those who trade on the 1001x platform pay 0.08% to enter and exit the market, which is considerably more expensive. Since 1001x doesn't support limit orders, all traders are market takers.

Traders who buy and sell cryptocurrencies on the Aster spot exchange pay 0.1% and 0.04% on limit and market orders. They also cover network fees depending on their preferred token standard.

Note that leveraged positions incur funding rates every eight hours. These fees vary by the pair and broader market conditions, but Aster displays them clearly on the trading dashboard.

| Trading Product | Limit Order | Market Order |

|---|---|---|

| Perpetual | 0.01% | 0.035% |

| 1001x | N/A | 0.08% |

| Spot | 0.01% | 0.04% |

Does Aster Support Fiat Deposits?

The Aster DEX does not support traditional payment methods like debit/credit cards and bank transfers. It’s a decentralized platform that runs on-chain without custodian services, so users must connect a wallet and add collateral from stored assets.

Those who do not yet hold cryptocurrencies may use a traditional online exchange to complete their purchase, and withdraw their coins to a non-custodial wallet.

Is Aster User-Friendly?

We tested the Aster DEX, and found that the platform suits various trading profiles.

The perpetual futures and spot trading dashboard appeals to experienced crypto traders who favor conventional order types. The 1001x platform is a better fit for “crypto degens” because users place directional positions (long or short) rather than bespoke orders.

Each Aster service offers a smooth and clean dashboard with customizable charting screens, drawing tools, and technical indicators. Diverse pricing timeframes range from one minute to one month, and desktop users can trade without needing to install software. While Aster offers a native app for Android users, the iOS version remains in test flight mode.

Regarding payments, users with previous DEX experience find the wallet connection process straightforward. First-time traders may, however, face a slight learning curve, as the exchange does not offer centralized deposit accounts.

Where Is Aster Exchange Available?

Like all decentralized exchanges, Aster is available globally. It cannot restrict traders based on location because of its decentralized non-custodial structure. Users trade pseudonymously via wallet-to-wallet connections, which adds an extra layer of privacy for those based in countries with prohibitive crypto trading laws.

One example is the UK. Crypto futures sites generally do not accept UK retail clients, as UK regulators restrict those clients from trading crypto derivatives. The regulator cannot realistically enforce these restrictions on platforms like Aster, which operate without centralized custody.

Does Aster Exchange Require KYC?

As one of the best no-KYC crypto exchanges, Aster does not collect personal information or ID verification documents. Traders speculate on digital assets without needing an account, as smart contracts execute positions via wallet connections.

The drawback of using a no-KYC platform is that users cannot deposit traditional money. Instead, collateral options include cryptocurrencies only.

Best Aster Alternatives

Before you trade spot or perpetual markets on Aster, consider other top platforms to make an informed choice.

Discussed below are the best Aster alternatives in 2025:

CoinFutures

In our view, CoinFutures is one of the best crypto trading futures platforms on the market. Unlike Aster, the beginner-friendly platform supports traditional payment types like debit/credit cards and Google/Apple Pay. Inexperienced traders avoid complicated on-chain transfers and smart contracts, and can deposit, trade, and withdraw via centralized accounts with full licensing.

While Aster offers 1001x leverage on BTC and ETH only, CoinFutures traders get 1000x on all supported futures. Other cryptocurrencies available to trade include DOGE, SOL, XRP, and Litecoin (LTC). The platform welcomes casual investors with limited funds, as the minimum trade requirement is just $1. Similar to Aster, CoinFutures users avoid cumbersome KYC processes.

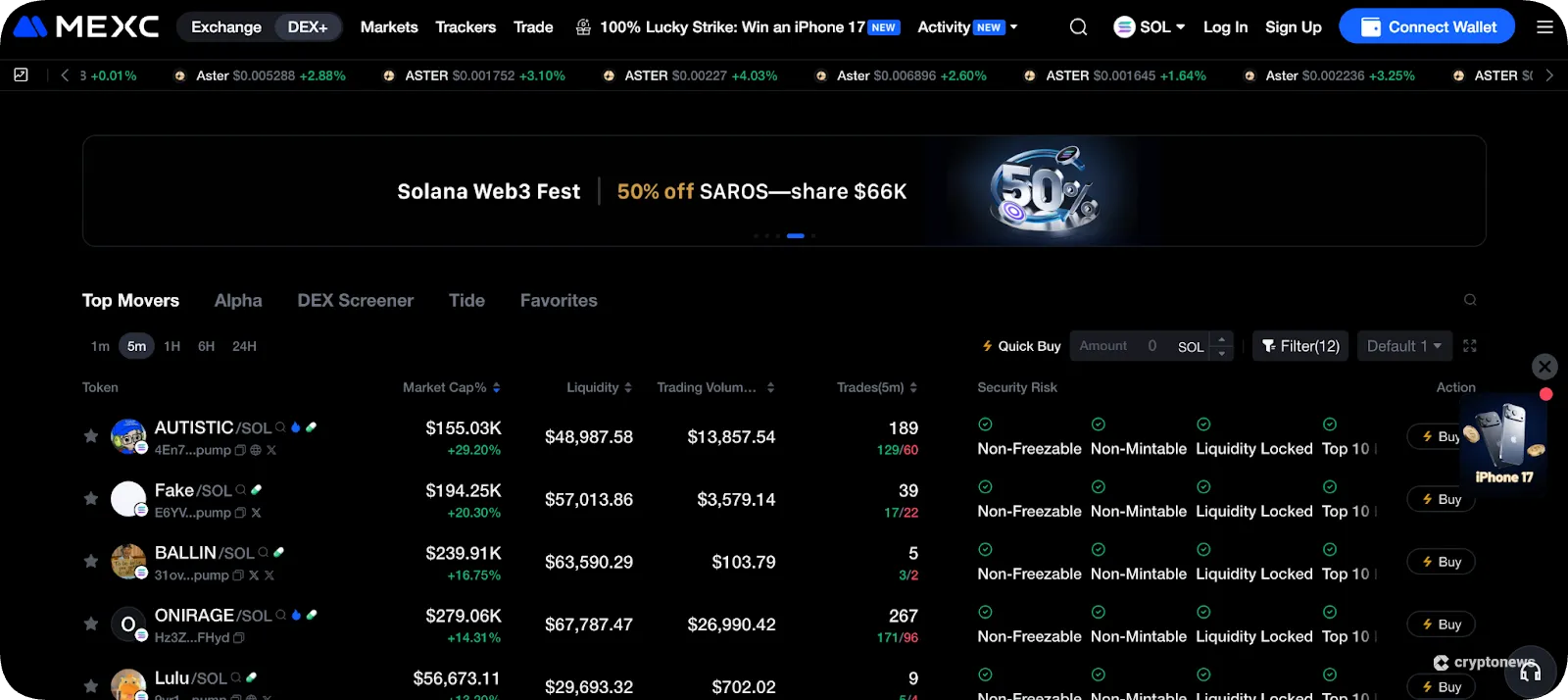

MEXC DEX+

MEXC DEX+ is an exchange aggregator that connects users with decentralized liquidity pools on four popular blockchains: BNB Chain, Solana, TRON, and Base. The exchange plans to launch other blockchains like Ethereum and Polygon soon. Traders access over 10,000 tokens via one-click trading, and order types include limits, markets, and stop-losses.

We like that MEXC combines centralized and decentralized features, as users can deposit fiat money while still accessing DEX markets. The provider also offers preprogrammed bots that trade DEX-based cryptocurrency pairs automatically. A drawback is that users need MEXC’s centralized account to apply leverage.

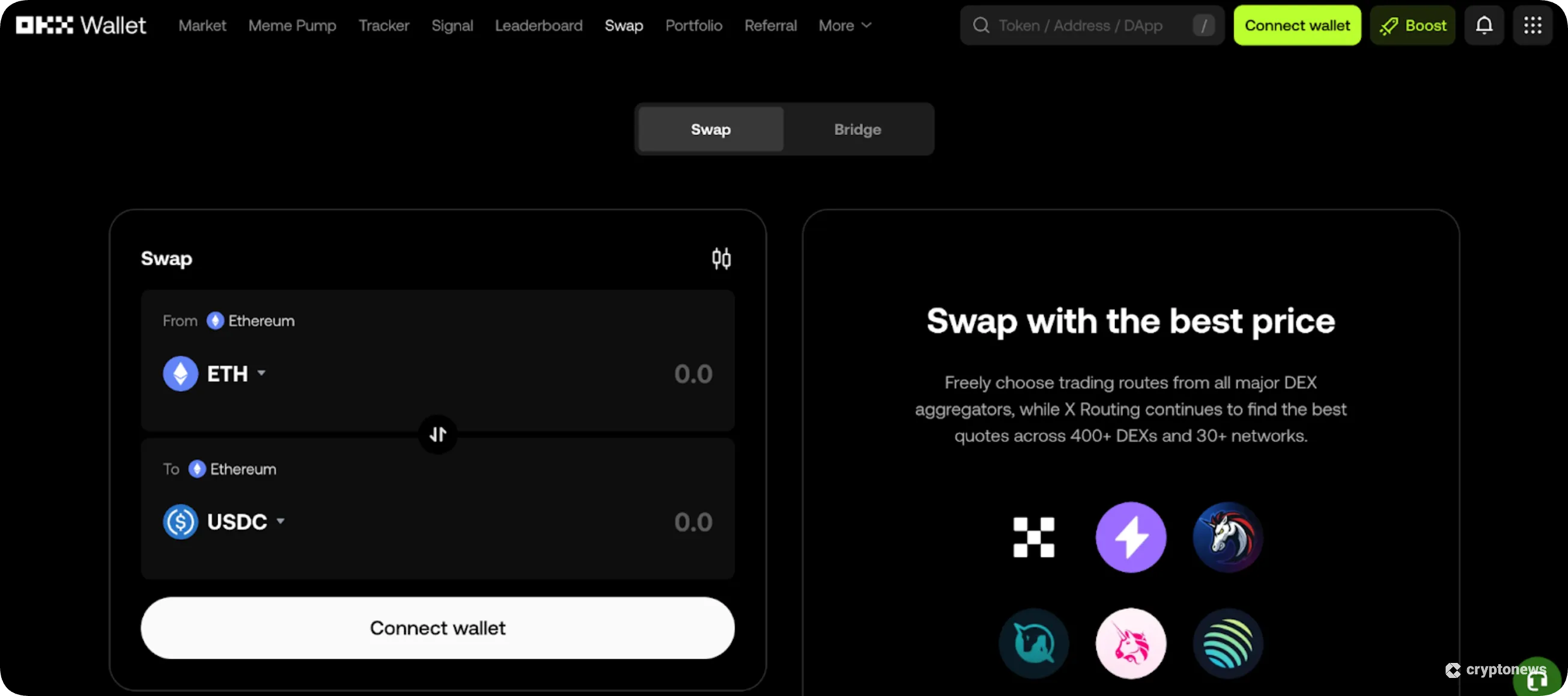

OKX DEX Swap

OKX DEX Swap is another exchange aggregator to consider. It routes trading orders to over 400 DEXs, including high-volume ecosystems like Uniswap, Jupiter, and Raydium. The platform supports more than 30 blockchains and Layer 2 networks, so traders may swap tokens across different standards.

The routing system ensures traders get the most competitive prices, and, if needed, split orders across multiple liquidity providers. Users access OKX DEX Swap via the exchange’s proprietary non-custodial wallet, or by connecting an external wallet like MetaMask.

How to Get Started With Aster

Follow these steps to trade leveraged cryptocurrencies on the Aster DEX.

Step 1: Get a Non-Custodial Wallet

Aster accepts wallet-to-wallet payments only for collateral. This requirement means you need a non-custodial wallet that connects with the Ethereum, Arbitrum, BNB Chain, or Solana blockchains. It should also support the WalletConnect feature.

One of the best crypto wallets for decentralized trading is Best Wallet, since it supports each of the above network standards. Other popular providers include MetaMask, Phantom, and Trust Wallet.

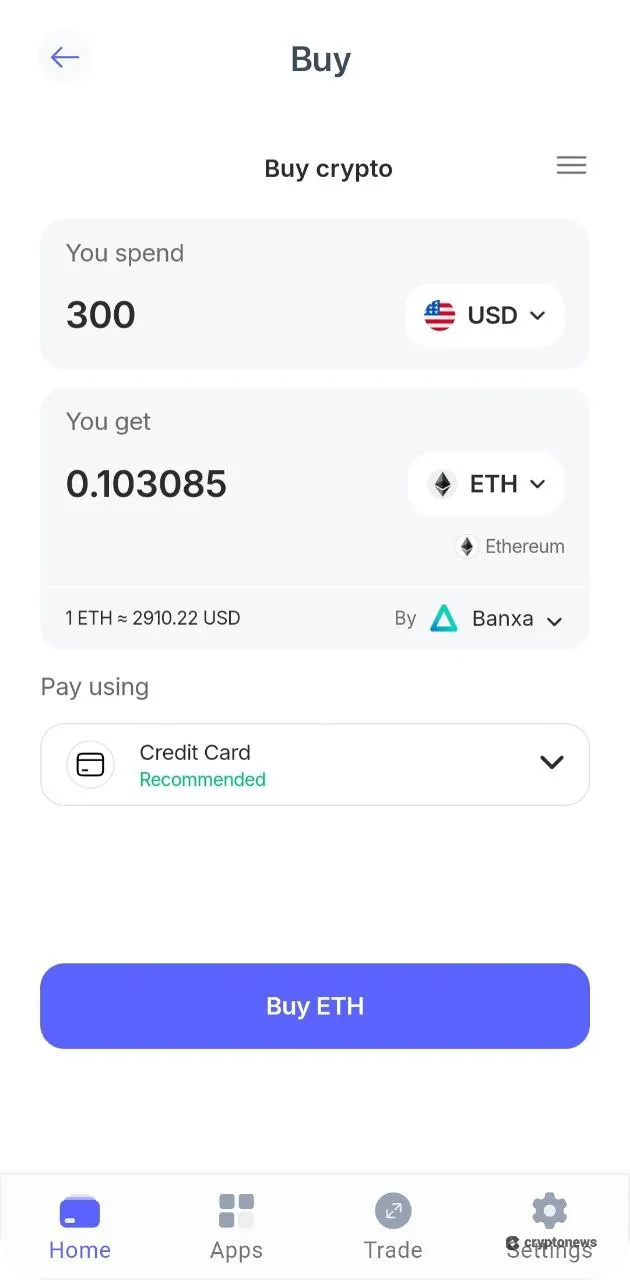

Step 2: Add USDT to the Wallet

Most Aster trading pairs contain USDT, so it makes sense to add the stablecoin to your wallet. You also need a small amount of the network’s native coin to cover gas fees. For example, USDT on the ERC-20 standard requires ETH, as it operates on the Ethereum blockchain.

Non-custodial wallets like Best Wallet offer instant crypto purchases with fiat money. Payment options include Visa, MasterCard, Skrill, Neteller, and Google/Apple Pay. Once you’ve bought USDT, use Best Wallet’s built-in DEX to swap some tokens for ETH.

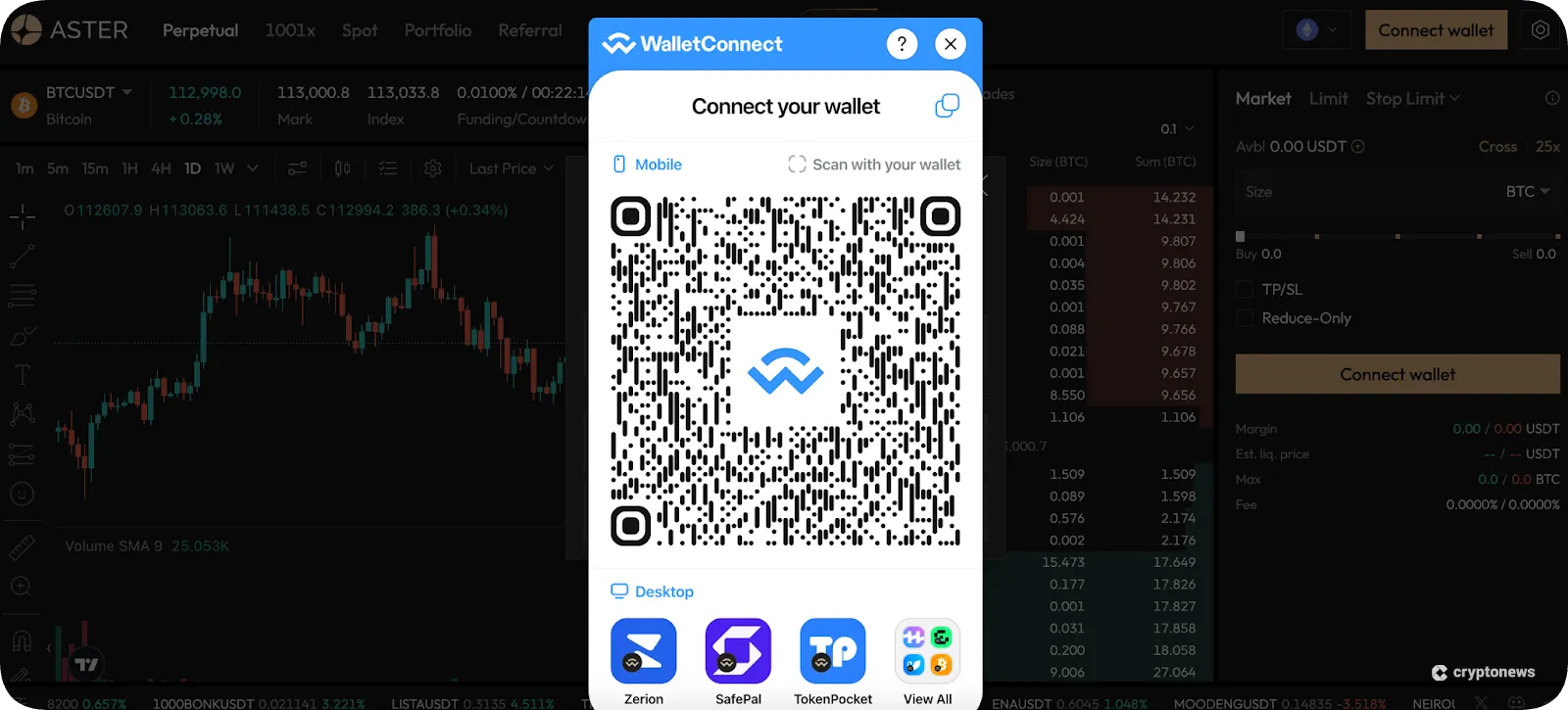

Step 3: Connect Wallet to the Aster DEX

Visit the Aster DEX website and select the preferred trading product, such as perpetual or 1001x.

Select “Ethereum” as the wallet network standard (or whichever network you’re using), followed by “Connect Wallet”.

Click “WalletConnect” and scan the QR code from the Best Wallet app. Then authorize the connection request.

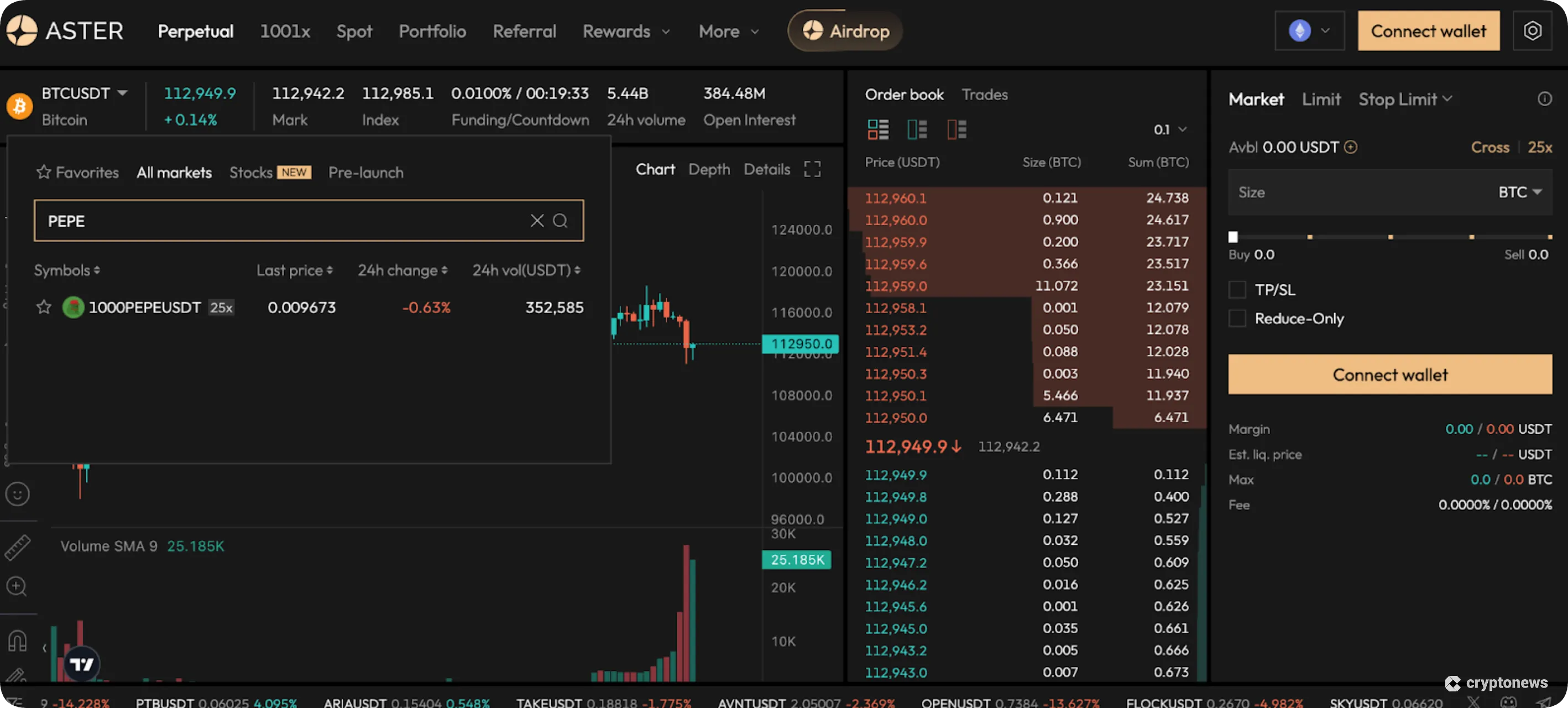

Step 4: Choose a Crypto Trading Pair

To the left of the pricing chart, click the arrow next to "BTCUSDT" to view available cryptocurrency trading pairs.

Scroll through the listed pairs or use the search bar to find a specific market.

Step 5: Start Trading

The final step is to set up a trading order. The order interface is located to the right of the pricing chart. Choose between a market or limit order, and input the stake and leverage multipliers.

Tick the “TP/SL” box to set up stop-loss and take-profit orders. Derivative experts recommend both risk management order types, especially when trading with leverage.

Review the order details, and confirm to enter the position.

Aster DEX Review Conclusion: Is It Worth It?

Aster’s near-instantaneous rise is unprecedented. Despite being one of the newest exchanges in the market, Aster already boasts $500 billion in trading volume and over 2 million active traders.

Our Aster DEX review found that key features include on-chain order books, support for spot and perpetual futures trading, and a maximum leverage setting of 1001x. Users can also place hidden orders for complete privacy and to avoid front-running bots.

Remember that Aster remains a non-custodial solution, so beginners cannot deposit or withdraw traditional money. Instead, Aster is a crypto-only exchange.

Our Methodology: How We Tested and Reviewed Aster

The research methodology for this Aster DEX review covers an extensive range of factors. We initially evaluated key platform metrics like supported assets and tradable instruments, margin requirements, average trading volumes, liquidity depth, and accessibility.

Our team also analyzed Aster project documents for trading fees, commissions, and expected slippage per product.

We then connected a funded non-custodial wallet to Aster to explore the trading experience. Research tasks included placing various order types, recording execution speeds, and comparing liquidity with on-chain figures. All research findings were scored by their importance, which enables readers to make informed decisions.

FAQs

Who is behind Aster DEX?

Is Aster exchange legit?

Is Aster better than Hyperliquid?

Is the ASTER crypto a good investment?

Where can I buy ASTER coin?

References